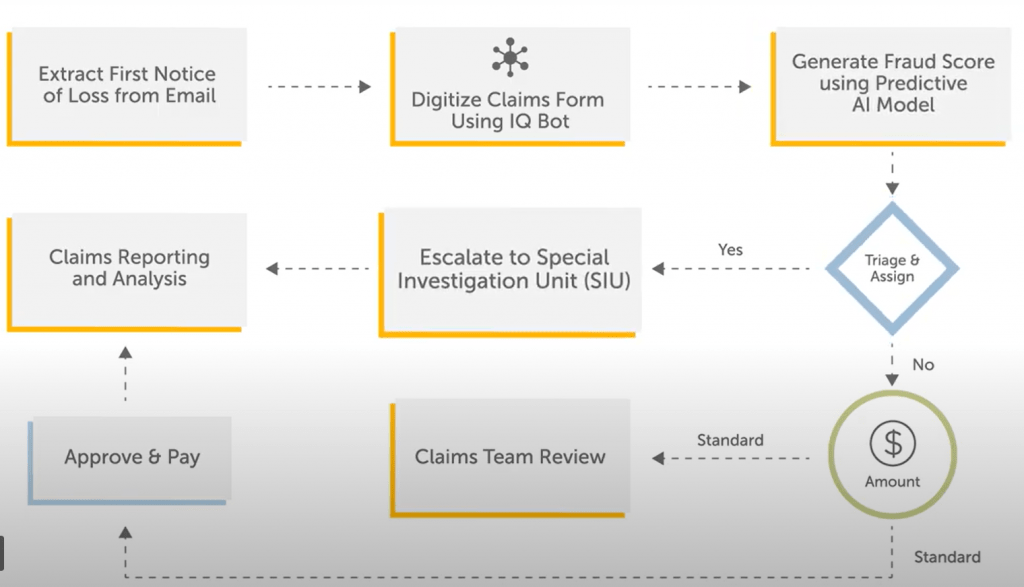

The policy holder starts the claim process by submitting a claim via email or other channels. This claim information is then automatically processed using a series of Bots. As emails arrive, the claim form’s data is extracted and placed in a claim-processing queue. A Cognitive Bot extracts the claim data using machine learning and creates a .CSV file from the data. This data includes such information as name, address, date, policy number, telephone number, email address, date and time of incident, and anything else that is required to process the claim. The system validates the customer account, takes in the claims information, and saves it in the system.

The claim is next passed to a bot that examines the claim data for signs of fraud. This bot uses cognitive analytics to predict the likelihood the claim is fraudulent. Claims that are determined to have a high probability of fraud are triaged into a special queue for analysis by experts in the special investigation unit. To ensure those claims are evaluated quickly, the system generates a notification to the SIU that an investigation and follow up is needed.

An additional benefit of the system is that claim analytics and reporting can easily be generated around the claim process to help managers optimize operational efficiency and effectiveness.

Here is a demo with Automation Anywhere RPA and IQ bot.

Source: Automation Anywhere